Top Guidelines Of Property By Helander Llc

Wiki Article

The Only Guide for Property By Helander Llc

Table of ContentsThe Best Guide To Property By Helander LlcThe smart Trick of Property By Helander Llc That Nobody is Talking AboutRumored Buzz on Property By Helander LlcThe Property By Helander Llc DiariesThe Basic Principles Of Property By Helander Llc About Property By Helander Llc

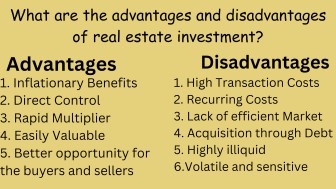

The benefits of buying property are countless. With well-chosen possessions, financiers can delight in foreseeable capital, outstanding returns, tax obligation advantages, and diversificationand it's feasible to utilize property to construct wealth. Thinking of buying property? Here's what you require to learn about realty advantages and why realty is thought about a good financial investment.The advantages of investing in genuine estate include easy revenue, steady cash flow, tax obligation benefits, diversification, and take advantage of. Genuine estate investment counts on (REITs) provide a method to invest in genuine estate without having to have, run, or money buildings.

In a lot of cases, capital just enhances over time as you pay for your mortgageand construct up your equity. Investor can benefit from numerous tax breaks and deductions that can save money at tax time. Generally, you can deduct the sensible expenses of owning, operating, and managing a property.

The Best Strategy To Use For Property By Helander Llc

Realty values tend to increase over time, and with a great financial investment, you can transform an earnings when it's time to offer. Leas also tend to rise over time, which can lead to higher capital. This chart from the Federal Book Financial Institution of St. Louis reveals mean home prices in the united stateThe locations shaded in grey show U.S. recessions. Mean List Prices of Homes Offered for the United States. As you pay down a residential or commercial property mortgage, you construct equityan possession that's component of your total assets. And as you build equity, you have the take advantage of to buy even more residential or commercial properties and boost money circulation and wealth a lot more.

Since property is a concrete possession and one that can function as collateral, financing is easily available. Realty returns vary, relying on elements such as location, possession course, and management. Still, a number that several financiers go for is to beat the typical returns of the S&P 500what many individuals describe when they say, "the market." The rising cost of living hedging capability of property stems from the positive partnership between GDP growth and the need genuine estate.

Getting The Property By Helander Llc To Work

This, in turn, converts right into greater resources worths. Genuine estate often tends to maintain the purchasing power of capital by passing some of the inflationary pressure on to occupants and by integrating some of the inflationary pressure in the form of capital appreciation - realtor sandpoint idaho.Indirect real estate spending includes no straight ownership of a home or residential or commercial properties. There are a number of ways that possessing actual estate can secure versus inflation.

Lastly, buildings financed with a fixed-rate car loan will see the relative amount of the monthly mortgage settlements drop over time-- for instance $1,000 a month as a set payment will certainly end up being much less troublesome as rising cost of living erodes the buying power of that $1,000. Often, a key home is ruled out to be a property investment because it is used as one's home

Our Property By Helander Llc Diaries

Even with the help of a broker, it can take a few weeks of work simply to discover the appropriate counterparty. Still, realty is a distinct asset class that's straightforward to recognize and can enhance the risk-and-return profile of a financier's portfolio. On its own, property supplies capital, tax breaks, equity building, affordable risk-adjusted returns, and a bush against rising cost of living.

Investing in property can be an incredibly satisfying and lucrative endeavor, yet if you resemble a great deal of brand-new financiers, you may be questioning WHY you need to be purchasing property and what benefits it brings over various other investment opportunities. Along with all the amazing advantages that come along with purchasing realty, there are some drawbacks you require to take into consideration also.

Everything about Property By Helander Llc

If you're looking for a way to purchase right into the genuine estate market without needing to spend numerous thousands of dollars, take a look at our properties. At BuyProperly, we utilize a fractional possession version that enables investors to begin with as low as $2500. One more significant benefit of realty investing is the ability to make a high return from purchasing, remodeling, and marketing (a.k.a.

Getting The Property By Helander Llc To Work

For instance, if you are charging $2,000 rent per month and you incurred $1,500 in tax-deductible expenses per month, you will just be paying tax obligation on that particular $500 revenue per month. That's a big distinction from paying tax obligations on $2,000 monthly. The earnings that you make on your rental device for the year is taken into consideration rental revenue and will certainly be tired as necessaryReport this wiki page